3 Easy Facts About Feie Calculator Explained

Table of Contents5 Easy Facts About Feie Calculator ExplainedNot known Factual Statements About Feie Calculator Feie Calculator Can Be Fun For AnyoneThe Only Guide for Feie CalculatorThe Basic Principles Of Feie Calculator

He sold his United state home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his other half to help accomplish the Bona Fide Residency Examination. In addition, Neil secured a long-term home lease in Mexico, with strategies to at some point purchase a residential property. "I currently have a six-month lease on a residence in Mexico that I can prolong one more 6 months, with the purpose to get a home down there." Neil aims out that buying residential or commercial property abroad can be challenging without very first experiencing the place."We'll absolutely be beyond that. Even if we come back to the US for medical professional's appointments or service phone calls, I question we'll invest even more than one month in the US in any provided 12-month duration." Neil stresses the relevance of stringent monitoring of U.S. brows through (Physical Presence Test for FEIE). "It's something that individuals need to be truly persistent about," he claims, and encourages deportees to be careful of common blunders, such as overstaying in the U.S.

Our Feie Calculator Diaries

tax responsibilities. "The reason why united state taxation on globally income is such a huge deal is because lots of people forget they're still based on U.S. tax even after transferring." The U.S. is just one of the few countries that taxes its residents despite where they live, indicating that even if a deportee has no earnings from U.S.

tax return. "The Foreign Tax Debt allows individuals working in high-tax countries like the UK to offset their U.S. tax liability by the quantity they've currently paid in taxes abroad," says Lewis. This guarantees that deportees are not strained two times on the same income. Nonetheless, those in low- or no-tax nations, such as the UAE or Singapore, face additional obstacles.

What Does Feie Calculator Do?

Below are several of the most frequently asked concerns regarding the FEIE and various other exclusions The International Earned Income Exemption (FEIE) permits united state taxpayers to exclude up to $130,000 of foreign-earned revenue from federal revenue tax, reducing their united state tax obligation. To qualify for FEIE, you should fulfill either the Physical Visibility Examination (330 days abroad) or the Bona Fide Residence Examination (confirm your primary home in an international nation for a whole tax obligation year).

The Physical Existence Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Visibility Test also calls for united state taxpayers to have both an international income and an international tax obligation home. A tax home is defined as your prime area for business or work, no matter of your family members's residence.

Not known Factual Statements About Feie Calculator

An income tax treaty between look at this website the united state and another country can assist prevent double tax. While the Foreign Earned Earnings Exclusion lowers gross income, a treaty may supply extra benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a called for declare U.S. citizens with over $10,000 in foreign monetary accounts.

Qualification for FEIE relies on meeting particular residency or physical visibility examinations. is a tax obligation consultant on the Harness system and the founder of Chessis Tax obligation. He is a participant of the National Association of Enrolled Brokers, the Texas Culture of Enrolled Brokers, and the Texas Culture of CPAs. He brings over a decade of experience helping Big 4 companies, suggesting migrants and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the owner of The Tax Guy. He has more than thirty years of experience and now concentrates on CFO solutions, equity payment, copyright taxes, cannabis taxation and divorce related tax/financial preparation issues. He is an expat based in Mexico - https://feiecalcu.start.page/.

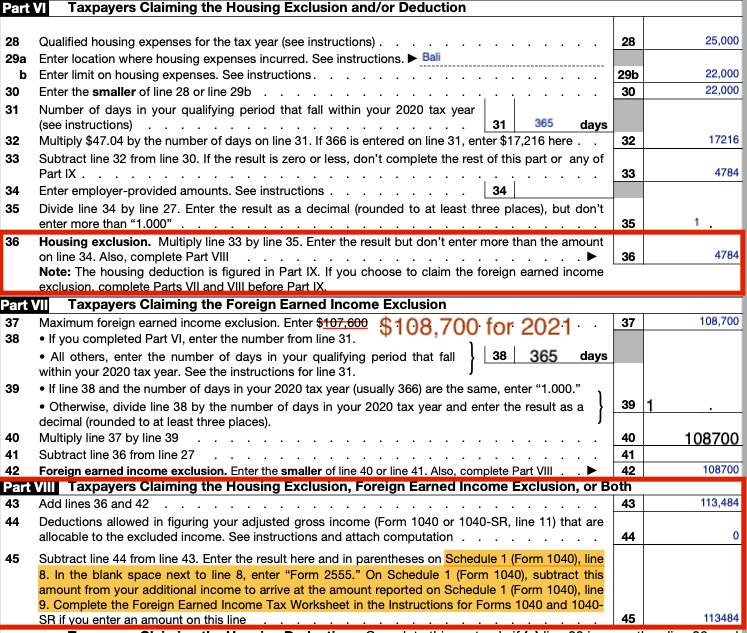

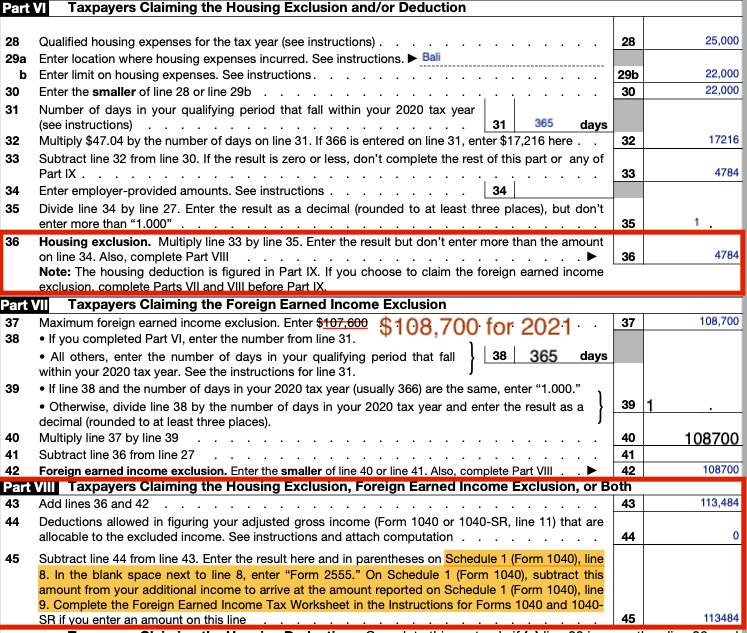

The international made earnings exemptions, occasionally referred to as the Sec. 911 exemptions, exclude tax on incomes made from working abroad. The exemptions comprise 2 parts - a revenue exclusion and a housing exclusion. The adhering to FAQs go over the benefit of the exclusions including when both spouses are expats in a basic manner.

Not known Details About Feie Calculator

The revenue exclusion is now indexed for inflation. The optimal yearly revenue exclusion is $130,000 for 2025. The tax advantage excludes the earnings from tax obligation at bottom tax prices. Formerly, the exclusions "came off the top" lowering earnings based on tax at the top tax rates. The exclusions might or may not reduce income utilized for other purposes, such as IRA restrictions, youngster credit histories, individual exceptions, etc.

These exclusions do not excuse the earnings from US taxes however simply give a tax decrease. Keep in mind that a bachelor working abroad for all of 2025 that earned regarding $145,000 with no other earnings will have gross income minimized to no - properly the same solution as being "tax free." The exemptions are calculated each day.

Comments on “7 Simple Techniques For Feie Calculator”